Research & Development (R&D) Tax Credits

These tax credits are available to pharma and biotechs to incentivize drug development and clinical research in countries around the world. In this article, we will discuss the United Kingdom’s R&D tax credit program, which is part of its post-Brexit strategy to boost innovation in drug development within its borders.

First, a bit of information about Precision for Medicine. We are more than just a Contract Research Organization and have a comprehensive suite of capabilities to support the spectrum of biopharmaceutical companies’ needs across the drug development lifecycle. We will share later on in this article what services we can provide locally in the United Kingdom, which will help Sponsors (Biotech and Pharma) take advantage of the UK R&D tax credit program.

Disclaimer: This article is for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. Please consult your own tax, legal, and accounting advisors before engaging in any UK tax credit applications.

Insights into the UK R&D Tax Credit Program

Now, let’s dive back into the information we have to share. UK biotechnology companies are considered a critical hub of innovative drug development, and the UK’s R&D tax relief program is particularly beneficial to drug development innovation conducted in the country. Indeed, R&D expenses can be claimed on activities performed throughout the drug development process. The United Kingdom government has a very helpful website that explains how the process works. We will cite a few areas below, and a link to their website is here.

The UK technically offers two R&D tax relief pathways:

- R&D relief for small or medium-sized enterprises (SMEs)

- R&D Expenditure Credit (RDEC)

We will focus on the former, the R&D program available for eligible small or medium-sized enterprises, defined by UK government as follows:

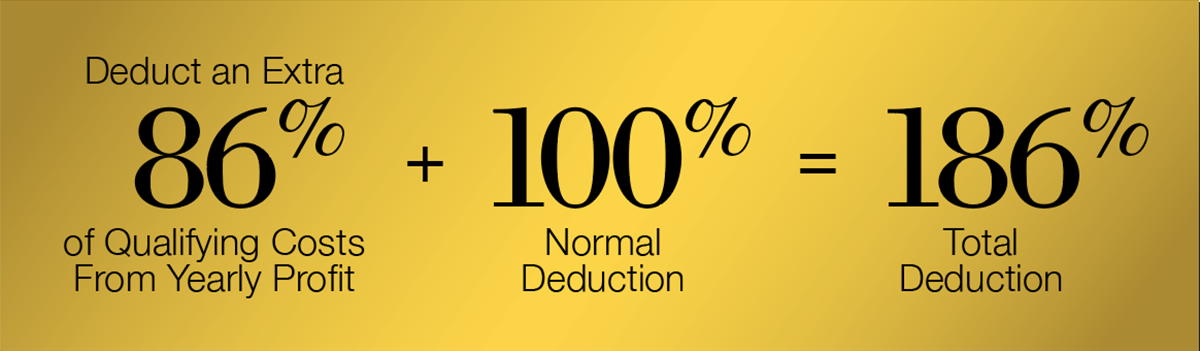

Where the above conditions are met, and per tax authority guidance1 the following relief is available:

Claim tax credit if company is loss-making, worth up to 10% of the surrenderable loss.

Claim tax credit if company is loss-making, worth up to 10% of the surrenderable loss.

If you are an eligible SME, as defined by the UK government, and want to claim your R&D tax credits, we encourage you to learn more about this on their website.

As a leading UK CRO, Precision for Medicine is exceptionally positioned to support our emerging UK BioPharma companies, allowing them to benefit from advantageous local R&D incentives.

Andrea Cotton-Berry, Global Head of Strategic Development

UK Based Services available from Precision for Medicine

Providing customized CRO solutions from late pre-clinical stage all the way through post-launch clinical trials, Precision for Medicine offers a unique partnership to promote innovation in the United Kingdom, prioritizing R&D activity development locally and maintaining close collaboration with UK R&D centers of excellence. Below is a list of available services based out of the UK.

| Laboratory Services | Clinical Trial Research |

|

|

Collaborate with a UK-based Partner

For small and emerging companies where you want to tap into UK R&D tax credits, it’s also critical to work with a partner with services and staff in the UK. This is where PFM can support your drug development innovation.

Learn how Precision can support your efforts.

References

- https://www.gov.uk/guidance/corporation-tax-research-and-development-tax-relief-for-small-and-medium-sized-enterprises

- UK R&D credit increase, faster drug approvals promised in budget speech – Endpoints News (endpts.com)

- Technical note: Additional tax relief for Research and Development intensive small and medium enterprise - GOV.UK (www.gov.uk)