Key Advantages of Running Clinical Trials in New Zealand

Clinical research in New Zealand (NZ) gives sponsors a strategic advantage across many indications through a fast, cost-effective trial start, particularly in early phase research.

Australia is second only to China in APAC in the number of industry-sponsored trials conducted. NZ, however, still conducts a significant number of trials with about 20-25% of Australia’s load, which is commensurate with its lower population.1–3 Given that NZ can start even faster than Australia, including in First-In Human (FIH) studies, it presents an excellent opportunity to supplement the highly popular and heavily-loaded early phase Australian sites. NZ offers the strategic advantage of an early view of data through cost-effective research.

1. Patient Demographics & Disease Burden

With a population of around 5.33 million (Mar 2025), NZ enjoys high life expectancy, though disparities persist—particularly among Māori and Pacific people.

The major contributors to disability-adjusted life years (DALYs) include cancer, cardiovascular, respiratory, musculoskeletal, and neurological disorders, with diabetes and mental health.4–5

In 2022, approximately 38,157 new cancer cases were recorded with 11,301 deaths.

Other Key Indications include:

- Autoimmune & Pain

- Cardiovascular

- CNS

- Diabetes & Obesity

Cancer deaths have steadily increased over the years, reflecting both population growth and aging however heart disease deaths show a gradual decline, likely due to improved prevention, treatment, and lifestyle changes.

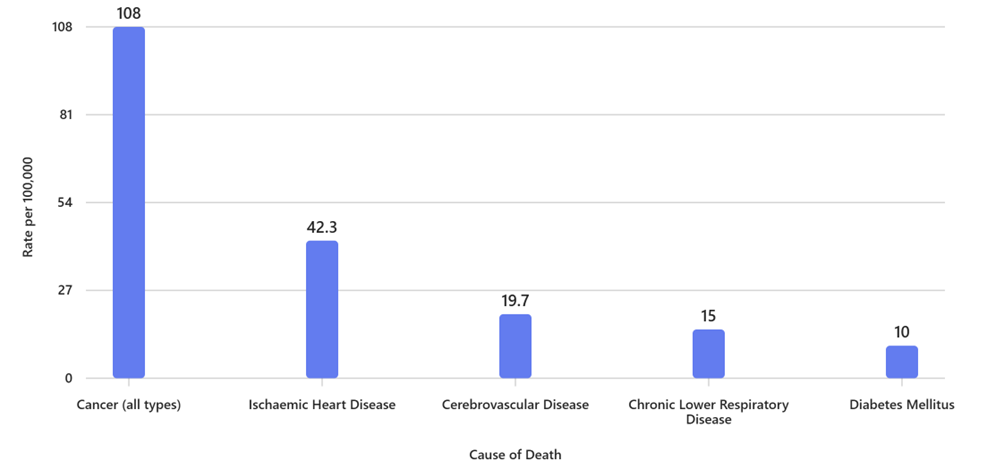

Top 5 Causes of Death in 2022

(Age-Standardised Rates per 100,000 Population)4

Leading Causes of Cancer Death (2022)6

- Lung cancer leads cancer mortality, accounting for nearly one-fifth of all cancer deaths (~18.8 %),

- Colorectal cancer follows as the second-highest cause of cancer death (~15.1 %),

- Aggregate of prostate, breast, and pancreatic cancers accounts for nearly 20% of cancer mortality combined. Melanoma is the 6th leading cause of cancer death.

2. Clinical Research Market & Universal Healthcare

NZ commits around NZD 493 million annually to health research, with projected returns of NZD 1.1–1.9 billion over 20–30 years. Between 2013–2018, clinical trials contributed over USD 150 million per year to the economy and supported over 700 full-time jobs.5,7

Why is New Zealand a Strategic Location for Clinical Trials?

New Zealand is an attractive strategic location for clinical trails due to:

- Fast regulatory timelines: NZ boasts one of the fastest ethics committee (EC) approval timelines and globally starts with no requirement for an IND, only one EC review and only 4–6 weeks from EC submission to trial start

- High-quality data aligned with ICH-GCP

- Cost efficiencies, including 15% R&D tax credits, competitive per-patient costs, favourable exchange rates, and lower PI and CRA salaries making trials in NZ 30–50% more cost-effective than in the U.S. or Europe7–10

- Supportive Ecosystem

Academic centres, and experienced clinical investigators provide robust infrastructure for integrating early phase trials. It's particularly strong in oncology, vaccines, rare diseases, and early-phase studies, making it ideal for early phase trials - Auckland City Hospital is a leading site for oncology trials, with experience across Phase I–III studies and a strong track record in solid tumours

- New Zealand Clinical Research (NZCTR), Pacific Clinical Research Network (PCRN)/Momentum, Harbour Cancer and Wellness offer early phase trials (including First in Human) trials

- Additionally, Middlemore Clinical Trials and the Christchurch Clinical Studies Trust have been cited for their contributions to rare disease research and early-phase studies, particularly in hematology and immunology

3. Healthcare System & Infrastructure

National Infrastructure Strategy

The Health Infrastructure Plan 2025 outlines a NZD 20+ billion investment to modernise hospitals, integrate ambulatory hubs (including radiology and oncology), and build linear accelerator (LINAC) bunkers within regional networks.11

Embedding Research in Clinical Networks

Clinical research is anchored within Health New Zealand and the Ministry of Health’s strategies, bridging hospital and primary care initiatives via shared infrastructure and workforce development.6

Facilities & Digital Investment

The April 2025 Health Infrastructure Plan outlines upgrading hospitals and digital systems to meet modern healthcare and research needs, addressing underinvestment and future capacity requirements.11

4. Regulatory Environment & Start-Up Timelines

NZ Clinical Trial Regulators12

- Medicines and Medical Devices Safety Authority (Medsafe) via Section 30 of the Medicines Act

- Health and Disability Ethics Committees (HDEC) for ethics review

Approval Timelines

- Medsafe: typically, 4–6 weeks for early-phase trials with an approval time of 45 days

- Ethic review through HDEC occurs concurrently (4-6 Weeks)

First-in-Human & Expanded Access12–13

New guidelines allow for FIH and early-phase oncology trials to be processed more efficiently, with clear reporting and safety monitoring standards.

Positioning New Zealand in Your Global Clinical Trial Strategy

New Zealand delivers on all fronts:

- Rich patient demographics and growing disease burdens, especially in chronic diseases.

- Effective investment and economic returns, supported by robust trial diversity.

- State-of-the-art infrastructure and equity-driven rollout, enabling wide access across trial phases and indications.

- Agile regulatory environment, favouring rapid start-up and streamlined pathways.

- Suitable for Phase I–IV studies, including interventional, device, and expanded-access trials across both common and niche therapeutic areas.

NZ is a trusted oncology location but is also well-positioned for CNS, cardiovascular, metabolic, immunology, and rare-disease research.

Sponsors and investigators benefit from New Zealand's agile ecosystem and integrated health system, making it an optimal choice for conducting high-quality, efficient, and diverse clinical programs.

-

Explore

Asia-Pacific CRO Services

ExplorePrecision's Asia Pacific CRO services provide you access to global expertise underpinned with regional insight to help you overcome barriers through every phase of your development journey.Asia-Pacific CRO Services

ExplorePrecision's Asia Pacific CRO services provide you access to global expertise underpinned with regional insight to help you overcome barriers through every phase of your development journey. -

Explore

/iStock-998338578.jpeg?width=396&height=416&name=iStock-998338578.jpeg)

Functional Service Provider (FSP)

ExploreAdd specialized staff quickly or build strategically aligned teams for complex projects. Precision FSP models adapt to your needs, integrate with your systems, and scale as your program evolves.Functional Service Provider (FSP)

ExploreAdd specialized staff quickly or build strategically aligned teams for complex projects. Precision FSP models adapt to your needs, integrate with your systems, and scale as your program evolves. -

Explore

%20CRO%20Services/iStock-1486286685%20(1).jpg?width=396&height=416&name=iStock-1486286685%20(1).jpg)

Speak with a Regional Expert

ExploreTell us about your upcoming project and we will connect you with the right team member, right away.

Speak with a Regional Expert

ExploreTell us about your upcoming project and we will connect you with the right team member, right away.

References

-

Siddiqui A. Medical advances soar with APAC’s clinical trial growth. BioSpectrum Asia. Published July 1, 2025. Available at: https://www.biospectrumasia.com/analysis/25/26280/medical-advances-soar-with-apacs-clinical-trial-growth.html. Accessed November 20, 2025.

-

Australian New Zealand Clinical Trials Registry (ANZCTR). Reports. Available at: https://www.anzctr.org.au/Reports.aspx. Accessed November 20, 2025.

-

World Health Organization. International Clinical Trials Registry Platform (ICTRP). Available at: https://www.who.int/tools/clinical-trials-registry-platform. Accessed November 20, 2025.

-

Health New Zealand – Te Whatu Ora. Official website. Available at: https://www.tewhatuora.govt.nz. Accessed November 20, 2025.

-

Ministry of Health NZ. Global Burden of Disease Study 2021 provides insights into the health of New Zealanders. Published May 17, 2024. Available at: https://www.health.govt.nz/news/global-burden-of-disease-study-2021-provides-insights-into-the-health-of-new-zealanders. Accessed November 20, 2025.

-

International Agency for Research on Cancer (IARC). New Zealand fact sheet – Globocan 2022. Available at: https://gco.iarc.who.int/media/globocan/factsheets/populations/554-new-zealand-fact-sheet.pdf. Accessed November 20, 2025.

-

New Zealand Institute of Economic Research (NZIER). Official website. Available at: https://www.nzier.org.nz. Accessed November 20, 2025.

-

Inland Revenue NZ. Research and development tax incentive. Available at: https://www.ird.govt.nz/research-and-development/tax-incentive. Accessed November 20, 2025.

-

Health Research Council of New Zealand. Investment Impact Report 2025. Available at: https://www.hrc.govt.nz/sites/default/files/2025-06/HRC%20Investment%20Impact%20Report%202025_FINAL.pdf. Accessed November 20, 2025.

-

Novotech CRO. Why New Zealand is emerging as a clinical trial hub. Published February 3, 2025. Available at: https://novotech-cro.com/blog/why-new-zealand-emerging-clinical-trial-hub. Accessed November 20, 2025.

-

Health New Zealand – Te Whatu Ora. Health Infrastructure Plan. Available at: https://www.tewhatuora.govt.nz/publications/health-infrastructure-plan. Accessed November 20, 2025.

-

Medsafe NZ. Clinical trials guidance. Available at: https://www.medsafe.govt.nz/medicines/clinical-trials.asp. Accessed November 20, 2025.

-

Health and Disability Ethics Committees (HDEC). Summary of major changes and rationale. Available at: https://consult.health.govt.nz/medsafe/clinical-trials-guideline-updates/supporting_documents/Summary_of_Major_Changes_and_Rationale.pdf. Accessed November 20, 2025.