Why Global Sponsors Are Launching Clinical Trials in Taiwan

Taiwan is rapidly emerging as a powerhouse in the global clinical trial arena. Taiwan is an increasingly attractive location for international clinical research, with an advanced healthcare infrastructure, diverse participant population, skilled medical workforce, and streamlined regulatory environment. These strengths, combined with a regulatory framework harmonised with international standards, make Taiwan a fertile ground for innovation in drug development and medical research. Taiwan meets pharmaceutical and biotech companies’ requirement for a cost-effective, and diverse trial environment.1

This blog explores the dynamic clinical trial landscape of Taiwan in 2025, uncovering the key drivers, opportunities, and challenges.

Diverse Patient Demographics and High Clinical Trial Recruitment Rates in Taiwan

Taiwan’s population is over 23.42 million (2024),2 concentrated in six major metropolitan areas. The high level of urbanisation and convenient transportation facilitates recruitment and follow up of study participants. With its aging population, Taiwan provides access to a wide range of participants in different therapeutic areas.

The top five causes of death in Taiwan include6:

- malignant neoplasms (cancerous tumours)

- heart disease

- pneumonia

- cerebrovascular disease

- diabetes mellitus

The wide range of common diseases supports diverse research areas, including oncology, neurology, respiratory disease, endocrinology and cardiovascular diseases (Chart 2).3

Number of IND Applications by Year (2014-2024)3 |

Percentage of IND Applications By Therapeutic Area, 20243 |

|

|

Taiwan’s Growing Clinical Research Market and Universal Healthcare Advantage

Taiwan is a growing market for Investigational Manufactured Products development and an attractive location for pharmaceutical, biotech and medical device companies. Additionally, the National Health Insurance (NHI) program provides universal healthcare access that benefits both patients and researchers.2

Taiwan’s Competitive Edge in Oncology Clinical Trials Across Asia

Approximately 47% of Investigational New Drug (IND) Applications submitted in 2024 were oncology trials.3 Taiwan has a strong cancer control infrastructure, including a population-based cancer registry4 and National Cancer Control Programs,5 and is engaged in research that helps quickly identify eligible participants for oncology trials.

The ten most common cancers by number of new cases in 2021 are2,4:

- lung, bronchus, and trachea;

- colon, rectum, sigmoid colon, and anus;

- female breast;

- liver and intrahepatic bile ducts;

- prostate;

- oral cavity, oropharynx, and hypopharynx;

- thyroid;

- stomach;

- corpus uteri; and

- ovary, fallopian tube, and broad ligament.

The well-established oncology treatment system offers advanced technology, comprehensive care, and good outcomes. In 2024, 99.9% of cancer diagnosis and treatment were covered by the NHI.2 Additionally, Taiwan offers a wide range of treatment modalities, including surgery, chemotherapy, targeted therapy, immunotherapy, and various radiotherapies like proton therapy1 and gamma knife radiosurgery.6

CAR-T and Cell Therapy Trials in Taiwan: Site Experience and Capacity

Taiwan is an active participant in CAR-T cell therapy clinical trials. From 2020-24, the National Taiwan University Hospital has conducted a total of 141 CAR-T trials in collaboration with 5 biotech and pharmaceutical companies worldwide, comprising 131 preclinical studies, 8 Phase I/II trials, and 2 Phase III trials.6

The experienced sites with CAR-T clinical trials in Taiwan include:

- National Taiwan University Hospital

- Taichung Veterans General Hospital

- Taipei Veterans General Hospital

- Chang Gung Memorial Hospital

Streamlined Regulatory Environment Enabling Faster Clinical Trial Start-Ups

Regulatory Authority

The standard review process for an initial clinical trial (IND) application by Taiwan’s Food and Drug Administration (TFDA) takes approximately 45 calendar days.7 The fast-track review available under the Multinational Clinical Trial Notification Scheme (CTN) reduces review time to 14 days if the protocol is simultaneously submitted to a notable regulatory authority (e.g., FDA or EMEA). CTNs now account for 30% IND trials.8

TFDA has also improved transparency and efficiency in clinical trial approvals by measures including:

- streamlining the review process

- defining timelines for different types of trial reviews9

- Improving communication with industry stakeholders

- Issuing guidelines on the implementation of Decentralised Elements in Clinical Trials with Medicinal Products (TFDA Jun 2023)3

Institutional Review Boards (IRB)

The IRB submission can be done in parallel with the IND. The central-IRB has 10 main-review IRBs (20 working days for approval) and 40 approved sub-review IRBs (20 working days for review post-central IRB review).10 This system is applicable for multicentre trial(s) that includes at least one site to be one of the main c-IRB review members.

Taiwan’s Advanced Healthcare Infrastructure and Skilled Clinical Research Workforce

Advanced Healthcare Infrastructure

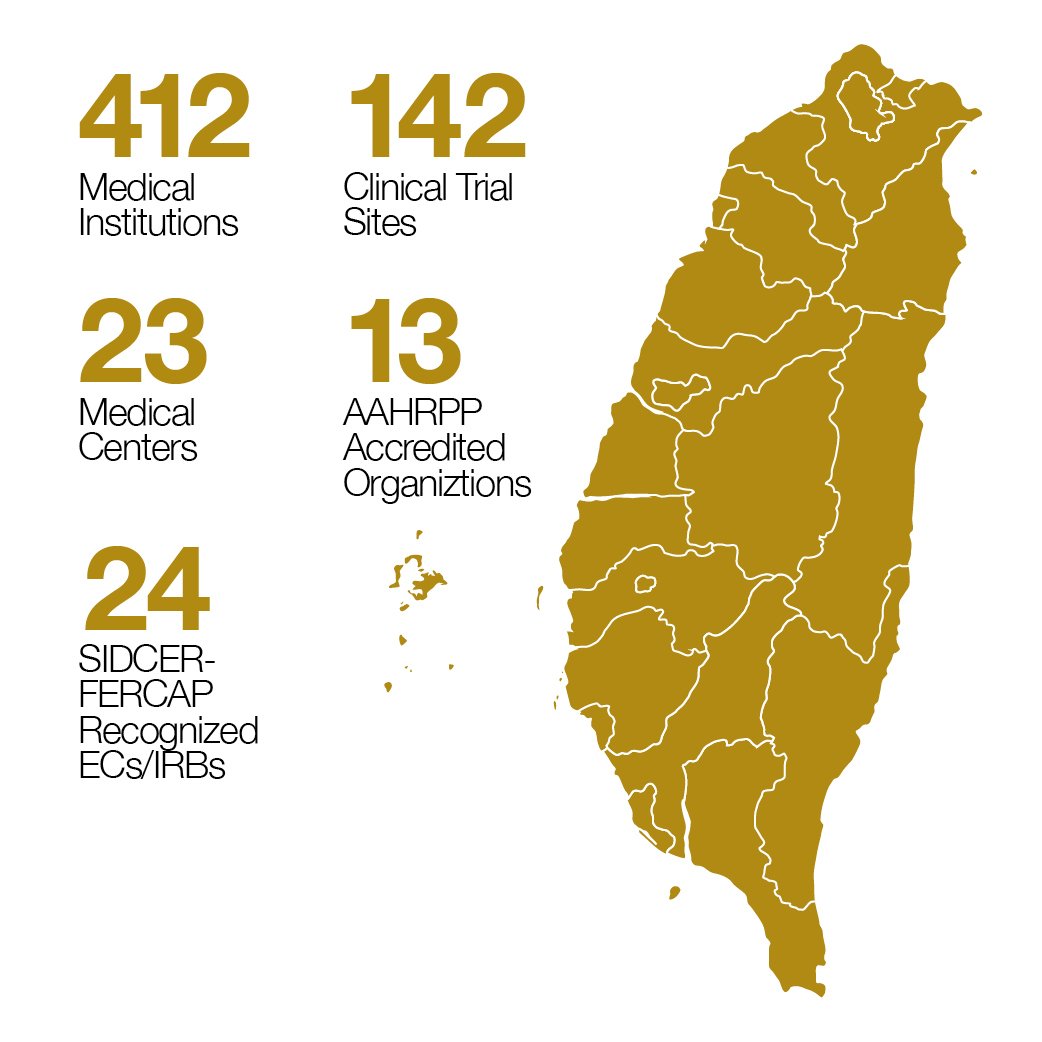

There are 412 qualified medical institutions and 142 qualified clinical trials sites by TFDA in Taiwan (May 2025).3,11

Table 1. Status of Medical Institutions, 20236

Highly Skilled Professionals

The government actively collaborates with industry and academia to promote the development process (Table 2).

Table 2. Taiwan Clinical Trials - Robust Partnerships3

| Taiwan Clinical Trial Consortium (TCTC) | TaiwanClinicalTrials.tw6 | Taiwan Principal Investigator Database (TPIDB)12 |

| The TCTC was funded by the Taiwan MOHW, bringing together 14 disease-specific consortiums involving 300+ experienced principal investigators and medical professionals. | The Taiwan Clinical Trials website provides up-to-date comprehensive clinical trial information, including regulatory information, health statistics, and clinical trial centres. | The TPIDB is a public resource that contains information on clinical trials approved by the TFDA, combining 2,000+ PIs, 5,000 MDs and operation site data. |

The government has adopted regulatory measures on medical education and training. There were 23 medical specialties, and 59,863 physicians who received their medical specialty licenses by December 2023.3

All experts conducting clinical trials must receive relevant training of more than 30 hours within the past 6 years and if conducting Human Trials of somatic cells or gene therapy, then 5+ additional hours are required.13

Taiwan’s Role in Expanding Clinical Trial Access to China

The Cross-strait Medicine and Health Cooperation Framework Agreement between Taiwan and China (2010) facilitates the exchange of information in healthcare and clinical research. This has accelerated drug approval process allowing more drugs developed in Taiwan to enter China early.

Four Taiwanese clinical trial are recognised by China:

- Taiwan Taipei Veterans General Hospital

- Tri-Service General Hospital

- Taiwan University Medical College Affiliated Hospital

- Linkou Chang Gung Memorial Hospital8

End-to-End Clinical Trial Support in Taiwan from Precision for Medicine

With its advanced infrastructure, efficient regulations, and diverse patient population, Taiwan offers an ideal setting for high-quality clinical trials. In this thriving environment, Precision for Medicine is well-positioned to deliver exceptional value.

Through its registered legal entity in Taiwan, Precision for Medicine is staffed by experienced clinical research and regulatory professionals who provide end-to-end support for clients’ clinical trials.

This local presence, backed by global expertise, enables seamless trial execution.

-

Explore

Asia-Pacific CRO Services

ExplorePrecision's Asia Pacific CRO services provide you access to global expertise underpinned with regional insight to help you overcome barriers through every phase of your development journey.Asia-Pacific CRO Services

ExplorePrecision's Asia Pacific CRO services provide you access to global expertise underpinned with regional insight to help you overcome barriers through every phase of your development journey. -

Explore

Clinical Trial Management

ExploreOur approach seamlessly blends innovation in early-phase trials with robust effectiveness in late phases, ensuring your research advances confidently towards its goals.Clinical Trial Management

ExploreOur approach seamlessly blends innovation in early-phase trials with robust effectiveness in late phases, ensuring your research advances confidently towards its goals. -

Explore

Speak with a Regional Expert

ExploreTell us about your upcoming project and we will connect you with the right team member, right away.

Speak with a Regional Expert

ExploreTell us about your upcoming project and we will connect you with the right team member, right away.

Frequently Asked Questions

How fast can a clinical trial secure regulatory approval in Taiwan?

The Taiwan Food and Drug Administration (TFDA) completes a standard IND review in ~45 calendar days. Under the Multinational Clinical Trial Notification (CTN) fast-track, review time drops to ~14 days when the same protocol is filed with a major agency such as the FDA or EMA. CTNs already represent 30 % of IND trials, and IND and Institutional Review Board (IRB) submissions can run in parallel.

Why is Taiwan a prime location for oncology clinical trials in Asia?

In 2024, 47 % of all IND applications in Taiwan were for oncology. The country supports these studies with a population-based cancer registry, National Cancer Control Programs, and National Health Insurance (NHI) coverage for 99.9 % of cancer diagnosis and treatment. Available modalities include surgery, chemotherapy, targeted therapy, immunotherapy, proton therapy, and gamma-knife radiosurgery.

What CAR-T cell therapy expertise is already in place in Taiwan?

Between 2020 and 2024, National Taiwan University Hospital conducted 141 CAR-T studies—131 pre-clinical, 8 Phase I/II, and 2 Phase III—working with five international biotech and pharmaceutical partners. Other experienced CAR-T sites are Taichung Veterans General Hospital, Taipei Veterans General Hospital, and Chang Gung Memorial Hospital.

How does Taiwan’s demographic profile boost patient recruitment for clinical trials?

Taiwan’s 23.42 million residents are concentrated in six major metropolitan areas with convenient transportation, making recruitment and follow-up efficient. An aging population supplies diverse cohorts across oncology, neurology, respiratory, endocrinology, and cardiovascular studies, matching global sponsors’ priority therapeutic areas.

References

- Taiwan Healthcare, Taiwan has the most particle therapy facilities in terms of population density (2023), https://www.taiwan-healthcare.org/en/news-detail?id=0rrsp7gbznvf9tdl#.

- The Ministry of Health and Welfare, Taiwan (2024) ‘2024 Taiwan Health and Welfare Report’, pages 20, 49-53, 57, 171, 175 and 176.

- Taiwan Clinical Trials (2025), Taiwan – Explore the potential of Asia, pages 1-2.

- Taiwan Cancer Registry Center (2021), Top 10 cancers in Taiwan, pages 1-3.

- Taiwan Health Promotion Administration, Ministry of Health and Welfare, Cancer Prevention and Control in Taiwan (2023). https://www.hpa.gov.tw/3840/10530/e.

- Taiwan Clinical Trials – Clinical Trial Centres. https://www.taiwanclinicaltrials.tw/ctc.

- Taiwan Food and Drug Administration (2019), Standard Review Process for Clinical Trial (IND) Applications, page 1.

- Credevo - Understanding Taiwan’s Clinical Trial Regulatory Process – Part 2 (2025). https://credevo.com/articles/2017/03/02/clinical-trials-in-taiwan-part-2-regulatory/.

- Taiwan Food and Drug Administration (2019), Review Process and Timeline for Clinical Trials (IND), page 1.

- Taiwan Clinical Trials – Taiwan Spotlight, centralised IRB mechanism. https://www.taiwanclinicaltrials.tw/spotlight/clinical_trial_overview/c_IRB/introduce.

- Taiwan Clinical Trials – Medical Institution statistics (2025). https://www.taiwanclinicaltrials.tw/spotlight/health_overview/medical_institution

- Taiwan Principal Investigator Database. https://tpidb.taiwanclinicaltrials.tw/.

- Taiwan Food and Drug Administration (2022), Regulations on Human Trials, Article 4.